Hľadaj

Zobraz:

Univerzity

Kategórie

Rozšírené vyhľadávanie

45 146

projektov

Finančné účtovníctvo

| Prípona .doc |

Typ ťahák |

Stiahnuté 41 x |

| Veľkosť 0,2 MB |

Jazyk anglický |

ID projektu 2007 |

| Posledná úprava 05.09.2016 |

Zobrazené 3 363 x |

Autor: - |

Zdieľaj na Facebooku

Zdieľaj na Facebooku |

||

| Detaily projektu | ||

- cena:

2 Kreditov - kvalita:

78,0% -

Stiahni

- Pridaj na porovnanie

- Univerzita:Univerzita Komenského v Bratislave

- Fakulta:Fakulta managementu

- Kategória:Finančníctvo » Účtovníctvo

- Predmet:Finančné účtovníctvo

- Študijný program:-

- Ročník:-

- Formát:MS Office Word (.doc)

- Rozsah A4:12 strán

- Dokumentácia:Stiahni

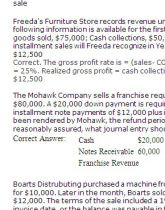

The accrual basis is generally considered to be superior to the cash basis in predicting a firm's future:Profitability

Which of the following represent the “net assets” of a company? Owner’s Equity

Which one of the following items is a period cost? Utilities expense in an office building

The accrual based income statement is designed to be used by investors in determining a firm's prospective cash flows

Which one of the following income statement classifications requires intraperiod tax allocation? Change in accounting principle from straight-line to double-declining balance depreciation

Which of the following represent the “net assets” of a company? Owner’s Equity

Which one of the following items is a period cost? Utilities expense in an office building

The accrual based income statement is designed to be used by investors in determining a firm's prospective cash flows

Which one of the following income statement classifications requires intraperiod tax allocation? Change in accounting principle from straight-line to double-declining balance depreciation

Kľúčové slová:

finančníctvo

účtovníctvo

multiple choice

company

manažment

Obsah:

- The accrual basis is generally considered to be superior to the cash basis in predicting a firm's future

Which of the following represent the “net assets” of a company?

Which one of the following items is a period cost?

The accrual based income statement is designed to be used by investors in determining a firm's prospective

Which one of the following income statement classifications requires intraperiod tax allocation?

In the year 2003, Born2Run Sports, Inc. changed to the weighted average method of valuing inventory from the LIFO inventory accounting method. How should the change be shown in their 2003 income statement?

Weebok Shoes decides to discontinue producing women’s basketball shoes in favor of focusing more on running shoes. In the process of discontinuing these shoes, Weebok disposes of some manufacturing equipment and acquires new, state-of-the-art equipment. The disposal of this old equipment would be reported on the income statement as

Which of the following is false regarding the term “component of an entity” as it relates to the discussion of discontinued operations in SFAS No. 144?

A special one-time charge resulting from corporate restructurings would be reported on the income statement as a(an)

GAAP requires that losses associated with the 9/11 terrorist attacks be reported on the income statement as part of

Treesdale Company acquired a machine for $360,000 on 1/3/01 and depreciated it using straight-line with an estimated useful life of eight years and no expected salvage value.

Bay Tree determined in January 2004 that the machinery would likely have only three remaining years of life and an expected salvage value of $15,000. The balance in accumulated depreciation as of 12/31/04 should be

Which one of the following is an element of comprehensive income?

Basic and diluted earnings per share (EPS) information is shown on the face of the income statement for all of the following items except

Hilltop Construction, Inc. began work in 2003 building a new section of highway for the state of Ohio. The project fee is $20,000,000. The estimated total cost is $15,000,000 over a three-year period. The following information is for 2003 only

Which one of the following is the correct cost ratio to use in computing the profit for 2003 under the percentage-of-completion method?

The percentage-of-completion method violates what general guideline on revenue recognition?

Question 4 is based on the following information for Manning Construction’s Job 264 which was completed in 2004.

Liverpool Company recorded $30,000 of sales under the cost recovery method in 2002. The cost of goods sold associated with these sales was $21,000 and cash collections over the next three years were: $15,000 in 2002, $10,000 in 2003, and $5,000 in 2004. What amount of gross profit should Liverpool recognize in the year 2003?

Under the installment sales method, revenue is generally recognized

Which of the following characteristics does not describe a liability?

Which of the following would not appear in the operating activities section of the statement of cash flows?

Which one of the following would be classified as a financing activity on the statement of cash flows?

The reporting of economic events in financial statements is sometimes distorted by

Which of the following ratios evaluates the effectiveness with which a company uses its assets?

What effect would the sale of a company’s trading investment securities for more than their carrying amounts have on the following ratios?

Which of the following is an item that analysts may decide to remove from financial statements of companies such as Krispy Kreme to understand normal operations? Other expenses related to the settlement of a business dispute

Which of the following would decrease a company’s intensity of asset utilization?

When a firm’s return on equity far exceeds its return on assets, the firm is making good use of

A company that employs a low-cost leadership strategy is associated with

Which one of the following describes a way in which cash flow available to stockholders can be used by a business?

In the discounted free cash flow (FCF) valuation approach, today's stock price is based on investors’